A Beginner's Guide to Trading: Unveiling the World of Financial Markets

Introduction:

In today's dynamic and interconnected world, trading has emerged as a popular avenue for individuals to participate in the global financial markets. Whether you're intrigued by the idea of making money from fluctuations in stock prices or curious about the intricacies of currency exchange, trading offers a thrilling and potentially rewarding venture. In this beginner's guide, we will demystify the world of trading and provide you with essential insights to get started on your trading journey.

In today's dynamic and interconnected world, trading has emerged as a popular avenue for individuals to participate in the global financial markets. Whether you're intrigued by the idea of making money from fluctuations in stock prices or curious about the intricacies of currency exchange, trading offers a thrilling and potentially rewarding venture. In this beginner's guide, we will demystify the world of trading and provide you with essential insights to get started on your trading journey.

1. Understanding the Basics:

Before diving into the complexities of trading, it's important to grasp the fundamental concepts. Learn about different financial markets such as stocks, bonds, commodities, and foreign exchange. Familiarize yourself with key terms like assets, positions, orders, and leverage. Gain an understanding of how supply and demand, economic indicators, and market trends can impact prices.

2. Setting Clear Goals and Strategies:

Successful traders have a clear vision of what they want to achieve and a well-defined strategy to reach their goals. Determine your risk tolerance and investment objectives. Develop a trading plan that outlines your approach, including the markets you want to trade, the timeframes you will focus on, and the indicators or analysis methods you will utilize. Remember, discipline and consistency are crucial in trading.

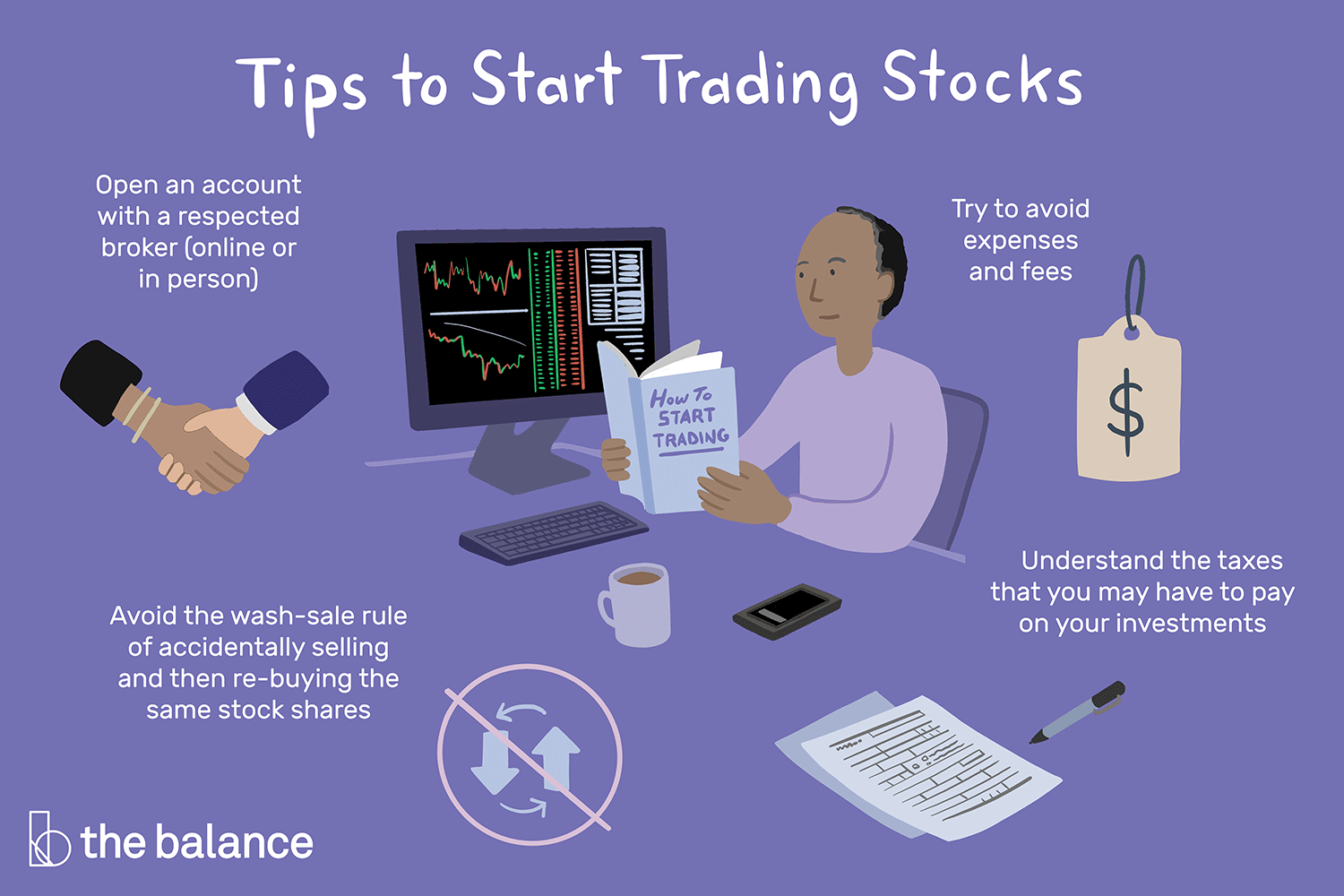

3. Choosing a Trading Platform and Broker:

To access the financial markets, you'll need a reliable trading platform and a reputable broker. Research different platforms and brokers, considering factors such as user-friendliness, available markets, trading tools, fees, and customer support. Ensure your chosen broker is regulated and offers a secure trading environment.

4. Learning Technical and Fundamental Analysis:

Technical analysis involves studying price charts, patterns, and indicators to predict future price movements. Explore popular technical analysis tools like moving averages, support and resistance levels, and oscillators. Additionally, understand the significance of fundamental analysis, which involves evaluating economic data, company financials, and news events to gauge market sentiment.

5. Practicing Risk Management:

Managing risk is paramount in trading. Never risk more than you can afford to lose, and employ risk management techniques such as setting stop-loss orders to limit potential losses. Diversify your portfolio to spread risk across different assets and markets. Continuously evaluate and adjust your risk management approach as market conditions change.

6. Embracing Continuous Learning:

Trading is an ever-evolving field, and staying updated with market trends and new strategies is vital. Read books, attend webinars, and follow reputable financial news sources to expand your knowledge. Join online trading communities to exchange ideas and insights with fellow traders. Remember, learning is a lifelong journey in trading.

Conclusion:

Trading can be an exciting and rewarding endeavor for those who approach it with dedication, discipline, and a thirst for knowledge. By understanding the basics, setting clear goals, and continuously improving your skills, you can navigate the world of financial markets with confidence. Remember to start small, be patient, and never stop learning. Best of luck on your trading journey!

Note: This blog post is for informational purposes only and does not constitute financial advice. Always conduct thorough research and consult with a qualified financial professional before engaging in trading activities.

Comments

Post a Comment